Trump wants influence over FOMC decisions. This is the second of three monetary policy themes, that can affect 2025. They all have both short and long term effect on the financial system.

Debt Markets Finance the Government's Deficit

Broadly and in the long term, FOMC decisions (monetary policy) steer the debt markets:

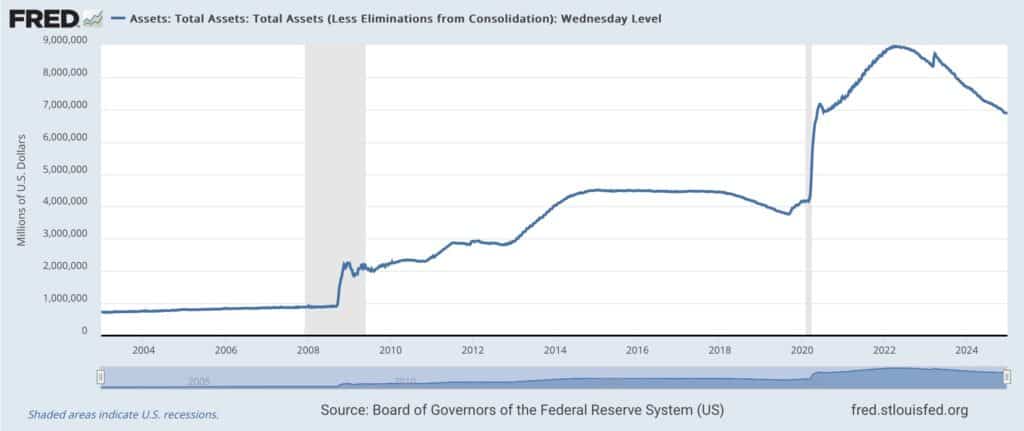

- Liquidity volumes have immediate effects: More liquidity, such as through QE, raises bid-to-cover ratios, pushing effective interest rates down and stock prices up.

- The more debt already in the market, the more financial stability relies on consistent liquidity availability.

- Taking lessons from the inflation shocks after Covid, central banks now aim to lower politicians’ expectations of central banks as “willing financiers,” as discussed in the previous blog post.

- The price of debt (interest rates) particularly shape the long-term economic growth expectations, particularly investment activity.

- Interest rates have broad and uncertain effects, varying by industry based on leverage and investment intensity. There is a “transformation time lag” between rate cuts and measurable macroeconomic impacts..

- Exchange rates reflect the currency's value and thus its purchasing power. This influences inflation with both short- and long-term timing.

Which is Why Trump Wants Influence Over Fed Policy

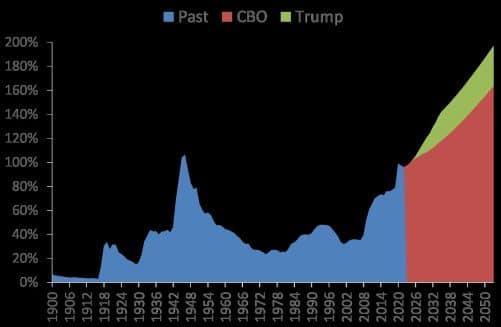

During his campaign and afterward, Trump repeatedly expressed a desire for political influence over FOMC decisions. This is critical for Trump because his tax cuts will increase the federal deficit, as discussed in the previous blog post as well as the below graphThe U.S. budget deficit is already structurally high and long-term in nature. Thus, Trump’s economic policy depends on the Fed resuming its role as a massive financier, i.e., increasing its purchases of Treasury bonds (federal debt).

Fed May Be Forced into the Financier Role to Ensure Financial Stability

If the Fed does not purchase enough bonds to balance supply and demand for liquidity, there is a risk of asymmetric liquidity shortages. This has not been widely seen since 2008, but such a shortage could disrupt financial stability through irrational market behavior.

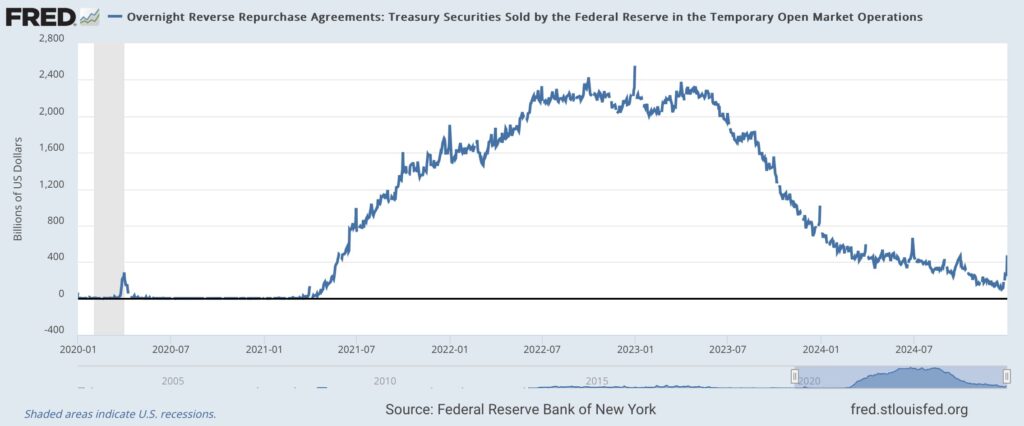

The risk of liquidity shortages has increased since the Fed resumed QT (balance sheet reductions) in June 2022. Since then, market liquidity has fallen to near-zero or neutral levels, evidenced by banks’ daily reverse repo transactions with the Fed. If this trend continues, asymmetrical liquidity shortages could arise as early as Q2 2025.

Converging Monetary and Fiscal Policy Has Been a Longstanding Taboo

Legally, there is no explicit prohibition in the Federal Reserve Act of 1913 against this.

Nevertheless, political interference in FOMC decisions would break the foundational principles of financial architecture, risking fiduciary trust. History is full of examples where such interference led to financial crises and collapses.

These lessons have shaped the thinking of leading economists such as Kydland and Prescott, as well as Rogoff and Reinhart. Their consensus is that independence fosters credibility, which enhances central banks’ ability to fight inflation effectively by reducing time inconsistency in monetary policy.

Independence has also been a cornerstone of Milton Friedman’s advocacy for rule-based monetary policy to minimize inflationary effects. This principle is central to the libertarian wing of the Republican Party, which helped secure Trump’s election. Reconciling this break with Friedman’s ideas may require Trump (and Scott Bessent) to craft a semantic bridge.

Independence is the Basis for Credibility

Shortly after the election, Fed Chair Jerome Powell stated that the Fed alone controls monetary policy. When directly asked if Trump agreed, Powell pointed out that his term doesn’t end until May 2026. Powell hinted that Trump would have to either dismiss him prematurely or confront the Fed in the markets, forcing it to buy Treasury bonds to ensure financial stability.

Dismissing Powell wouldn’t “solve the problem,” as FOMC decisions are made by majority vote among its 12 members. Most of their terms run well beyond 2032. Hence, Trump would likely need to rely on a market-based confrontation to pressure the Fed into acting as a financier.

This could damage the Fed’s credibility in both markets and the broader public. The Fed would face the challenge of opposing the world’s most powerful political position, while Trump wields control over social media and has recently secured the support of a majority of U.S. voters.

The ECB Faces a Different, but Potentially Similar, Dilemma

A similar conflict is unlikely in the EU in the short term.

The ECB’s mandate is formally limited to inflation and financial stability, not economic growth. This differs from the Fed’s dual mandate. Moreover, the ECB’s approach remains rooted in Otmar Issing’s “two-pillar” philosophy.

By contrast, Mario Draghi’s September report called for joint debt issuance as part of a series of cohesive recommendations. However, issuing additional debt equivalent to 5% of EU GDP annually cannot be financed by markets alone. The ECB would need to increase liquidity to maintain financial stability, particularly if it lowers interest rates faster than the U.S.

Click here for the first post in the trilogy on how central banks seek greater autonomy and reduced liquidity stimuli..

Click here for the last post in the trilogy on how Trump wants a drop in the usd value.