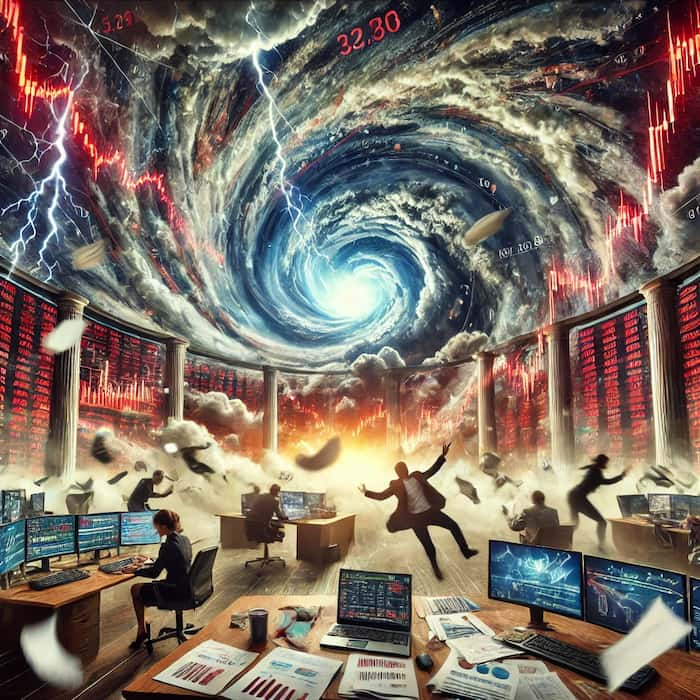

Chaos in the financial markets is uncomfortable. It is only afterwards, that history can be written simply and thus comfortable. While events unfold, outcome possibilities are often felt as chaotic.

Chaos can lead to fear

Chaos is integral to the original state of objects. It is thus natural. But chaos leads to fear. Fear arises from sudden unforeseen events, that we cannot grasp or overview, and therefore cannot predict how we best maneuver effectively in. Fear thus often stems from where we felt most comfortable.

We typically associate the word chaos with something unusual, that disturbs balances. In reality though, chaos (entropy) is everywhere. But if chaos is so normal and natural, why does the world look so ordered? Trees and lakes are e.g. in the same place day after day, and forms of life have a tendency to evolve in the same way, head for the same places and group themselves.

Henrik Poincaré discovered that chaos is integral to an objects original condition. Boltzmann described, how chaos increases with activity. Finally, Edward Lorenzdescribed how rounding of very small decimals can suddenly produce very different long time predictions, i.e. chaos. This affects a.o. meteorological projections.

Controlling chaos is therefore about preventing that small changes can lead to large and unpredictable consequences. But is chaos control at all possible in reality?

Chaos control requires us to identify the changes early

There is a lot in the physical universe, that we cannot explain, because we cannot see it.

- Gravitation is an example of something that we can measure and predict. But we don't understand it, and thus can't explain it.

- Of the total energy in the universe, “dark energy” makes up 68,3%. This we can calculate, but we can't see it. The unfortunate about this is, that it is the "dark energy" that causes the expansion of the universe.

- On matter, the remaining 31,7%, 85% is comprised of "dark matter" (27% of all matter and energy in the universe). "Dark matter" does not interact with other types of matter, including light, which is why we can't see it etc.

Back to financial markets, chaos is thus an expression that there is a lot, that we don't know because we can't (or sometimes won't) see. But it is not unusual, and we can't avoid it. What we can do however, is to prepare ourselves and thereby mitigate som of the effects.

Risk management is therefore about consciousness on where fewest changes have happened in a long time. Here we are typically least prepared. Crisis management is about facing this risk.

”It’s only when the tide goes out, that you learn who has been swimming naked”, Warren Buffett